Punjab Budget 2024-25: Govt increases fees, duties to meet rising expenditure needs

Business

Punjab government aims to boost revenue through these measures

LAHORE (M Jahangir) – The Punjab government has proposed a significant increase in various fees and duties in the budget 2024-25, aiming to enhance revenue collection to address the rising expenditure need.

The proposed changes are part of the Finance Bill 2024-25, which was presented in the provincial assembly.

Court fees

The court fee under the Court Fees Act, 1870 is set to be amended, increasing fee by a substantial margin. The previous fees, which was unchanged for a considerable time, will be revised to maintain equilibrium with the rate of inflation.

The new fees will be: Rs5,000 up from Rs1,500 for suits above Rs1 million.

Rs2,000 up from Rs500 from suits between Rs500,000 and Rs1 million. Rs1,000 up from Rs200 for suits up to Rs500,000.

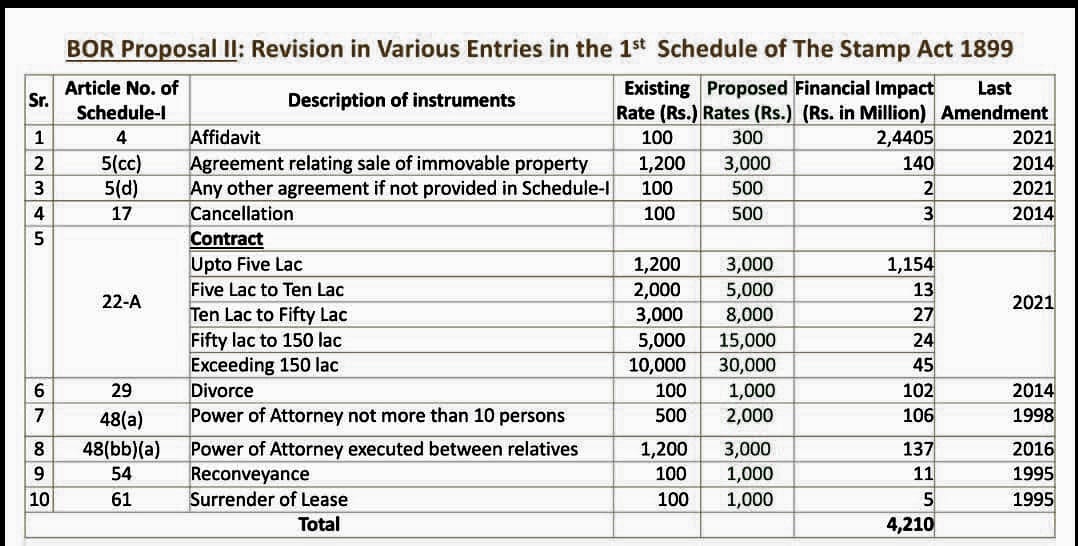

Stamp duty

Stamp duty under Stamp Act, 1899, will also be amended, revising the current rates.

The new rates will be: 5 percent raised from 3 percent on property transactions above Rs10 million.

Four percent raised from two percent on property transaction between Rs5 million and Rs10 million.

Three percent raised up from one percent on property transaction up to Rs5 million.

Token tax

The token tax regime is being shifted from engine capacity to invoice base value, with a life time token tax imposed on subsequent for 10 years. The tax rate will depreciate by 10 percent each financial year after registration.

Urban immovable property tax will make a transition from rental based valuation system to a capital value system, enhancing transparency and public benefit. Self-assessment will be introduced, promoting accountability among property owners.

Excise duty

The excise duty on Minerals (Labour Welfare) Act, 1967, will be amended, increasing the cess duty from Rs1-5 per ton to Rs30-50 ton.

This change aims to expand welfare facilities and fill the deficit gap in needs and available monetary resources.

The Punjab Sales Tax on Services Act 2012 will be amended to bring it in conformity with the other fiscal statues, ending litigation faced by the Punjab Revenue Authority (PRA).

According to the Punjab government, it aims to boost revenue through these measures, addressing the rising expenditure needs.

However, the increased taxes and fees may have an impact on the general public and businesses, affecting the economy.