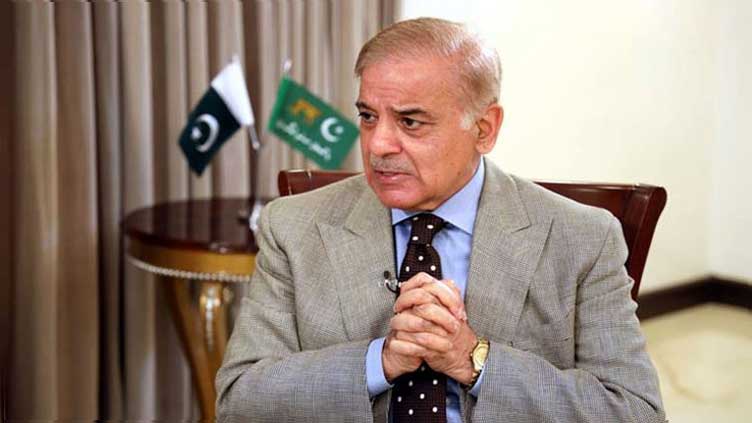

PM Shehbaz directs action against FBR officials complicit in tax evasion

Pakistan

Track-and-trace system in cement, sugar industry led to significant increase in tax revenue

ISLAMABAD (Dunya News) - Prime Minister Shehbaz Sharif on Tuesday chaired a high-level meeting to review efforts by the Federal Board of Revenue (FBR) to broaden the tax base and enhance revenue collection.

Stressing the need for accountability, the premier directed strict action against officials complicit in facilitating tax evasion.

The session was attended by federal ministers Azam Nazeer Tarar, Muhammad Aurangzeb, Ahsan Iqbal, Attaullah Tarar, the FBR chairman, and other senior officials.

Commending the economic team for progress toward achieving revenue targets for the current fiscal year, the prime minister reiterated that individuals and sectors with the capacity to pay taxes but remain outside the net must be brought in.

"Tax evasion will not be tolerated - enforcement must be strong and comprehensive," he asserted.

The prime minister emphasised the use of modern technology to curb tax evasion and underlined that expanding the tax base remained a top government priority.

“Our aim is to reduce the burden on the common man by lowering tax rates, which can only be achieved if more people contribute,” he said, directing that digital monitoring systems in the cement and other sectors be fully operational by June this year.

He further instructed authorities to accelerate efforts, in coordination with provincial governments, to enhance revenue from the tobacco industry.

Effective legal follow-up on pending tax-related cases was also stressed to safeguard public money.

“The country’s economy is stabilising and progressing by the grace of God,” he noted. “It is crucial that every citizen and institution plays its part in national development.”

The meeting was informed that the complete implementation of the track-and-trace system across cement plants has led to a significant increase in tax revenues.

In the sugar industry, the system reportedly contributed to a 35pc rise in revenue between November 2024 and April 2025. Officials also expressed confidence that ongoing FBR reforms would help achieve the targeted tax-to-GDP ratio of 10.6pc.